Special Market Update

Grain Market Commentary

Monday, August 2, 2021

by Kris Hatfield, Kearney NE Merchandising Team, The Andersons

Corn

September futures opened today at 5.47 and closed at 558 ¾. Dec opened at 5.45 and closed at 5.59.

Corn markets provide extra premium into the market with the less than expected rain over the weekend and hot dryer temperatures expected to return in the extended forecast. Rains over the central Midwest were welcomed by those who received them, as it was spotty at best to those who received them. Cooler temperatures are expected to begin the week, as much of the corn belt is expected to be in the low to mid 80’s for the better part of the week. This gives much needed relief from the hot and dry week we just went through. High temperatures and dry conditions are expected to return across the board by the end of the week and continue through the extended forecast. Rain is expected towards the end of the extended forecast, but the boundary continues to be drawn in the northwest IA and southern MN region. Those to the East should see some relief and those out West should expect the trend to continue of the dry weather. This is pulling into the overall volatility of the market as the market looks forward to the August 12th USDA report. While conditions have been favorable in many areas, passing the “road test” with a breeze, there seems to be a small concern of whether it is enough to keep the yields in line with the USDA expectations. The cooler temps will help aid in the process, but will it be enough to support the hot dry conditions forecasted?

Export inspections for the week saw a bit of a rally from the previous weeks as demand outside the US seems to be picking up a little speed at the moment. China leads the way in helping keep corn exports on an upwards trend. Concerns in South America still play the same picture WoW. Crop expectations for Brazil continue to trend lower with many expecting harvest totals to be short of 90mmt. Eyes will be continuing to look to China for any updates on whether they are going to continue their buying at the level of this week.

Technical: The Dec 21 market has traded back below the 50-day moving average last week and a return to what has been seen over the previous weeks. The Dec 21 futures have been trading relative to both the 50- and 100-day moving average range. Giving a small glimpse of a steady trade range going forward.

CZ21 December Corn Futures Chart (50 Day MA – Red, 100 Day MA – Green)

Soybeans

Market traded lower overnight, September futures opened at 13.55 and closed at 13.562. November futures opened 13.49 and closed at 13.53.

Soybeans tend to be on the opposite side of the field as the corn markets. While the rains in the early growing period benefited the corn crop, it has done the opposite to the soybean crop. The expected planted acres and an overly wet start to the growing season leave little room for error in terms of potential yield expectations. Any reduction to yield in the Aug 12th report will leave the balance sheet in an extremely tight environment as we go into the 21/22 marketing year. Headline news or any change than what is expected will move the market in either direction given the tight balance sheet. Looking outside of the US, developments in the Chinese hog farms production and demand for crush is going to be at the forefront of what to expect in the market as China tries to rebuild from the devastating African swine fever last year. Export inspections for the week were down almost 25% from the previous week. Brazil looks to expand its soybean crop again in the upcoming crop year and looks to expand around 2.5% YoY.

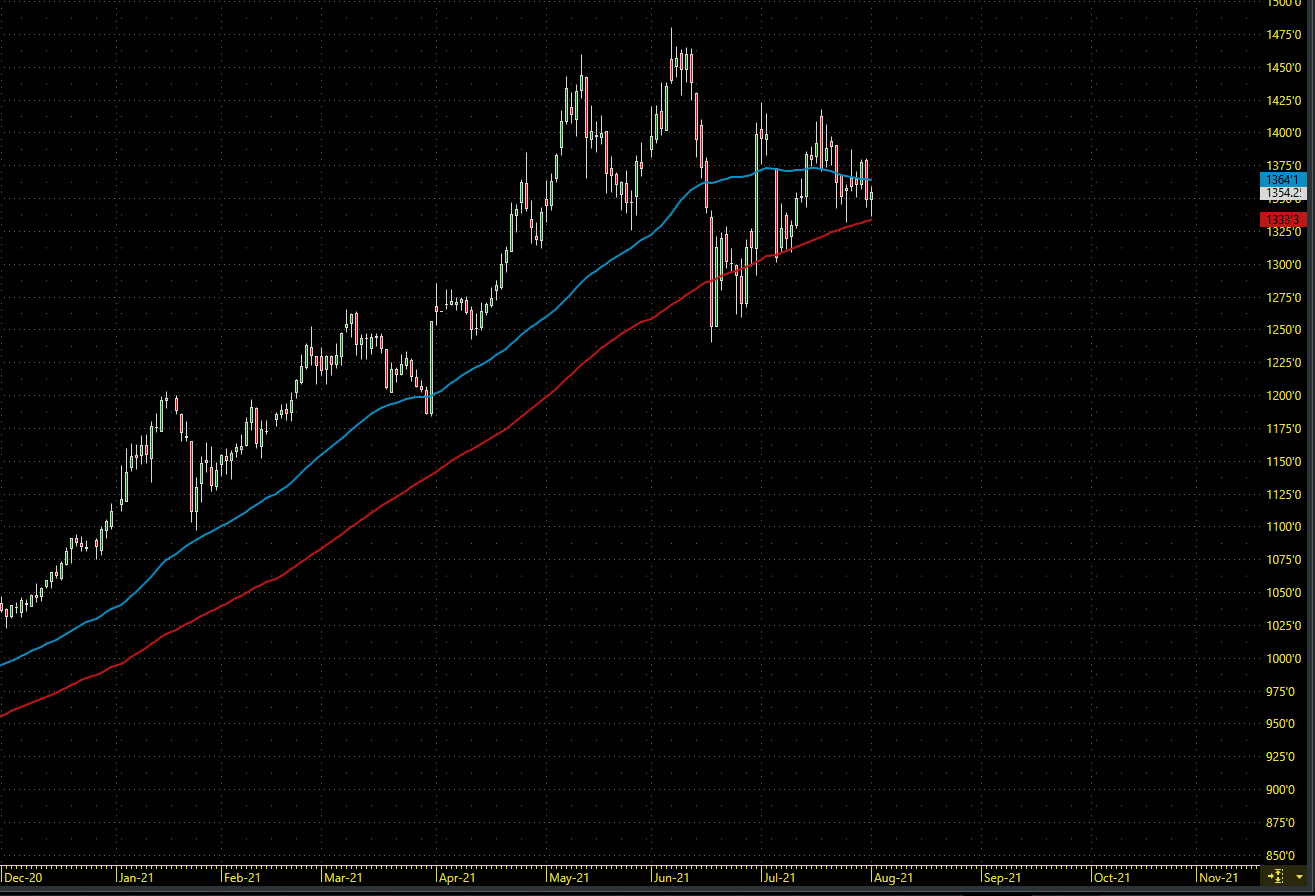

Technical: Overnight Soybeans are led by negative trade expectations. Putting pressure on the 100-day moving average. Giving it an overall bearish tone going into today’s trade. Reminder, beans have only fallen below the 100-day moving average once since last summer. In today’s session the market started off sluggish with the low of the overnight. Throughout the day prices rallied and ended the day slightly up for the day.

SX21 Soybeans Future Chart (50 Day MA – Blue, 100 Day MA – Red)

To Watch For: 4pm Eastern the weekly Crop Progress Report. Trade expectations look to see corn steady to 2% decreases. Soybeans steady to a 1% decrease.